Pearson predicted that 2005 would be a year of strong growth and financial progress, driven by education, our largest business. We have reported that Pearson Education had its best year ever; that the FT Group achieved a further significant profit improvement; and that we see good prospects for continued growth in 2006 and beyond.

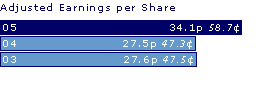

Pearson's sales increased 9% in 2005, the fastest rate of growth for five years. Adjusted operating profit increased by 22%, well ahead of sales, with profits improving in all businesses. Operating margin improved by 1.6% points to 12.4%. Adjusted earnings per share were 34.1p, up 24%.

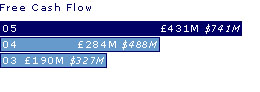

In 2005, Pearson generated more cash than ever before, increasing operating cash flow by £152m or 36% to £570m and free cash flow by £147m or 52% to £431m. Cash conversion was particularly strong at 113% of operating profit. The average working capital to sales ratio at Pearson Education and Penguin improved by a further 2% points to 27.4%, even as we continued to make a significant investment in new products and services that will support our future growth.

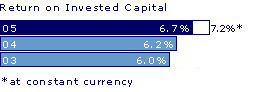

Our return on invested capital improved to 6.7%, or 7.2% at constant currency, from 6.2% in 2004.

Our statutory results show an increase in operating profit to £536m (2004: £404m) and in statutory basic earnings per share to 78.2p (2004: 32.9p), benefiting from a £302m profit from Recoletos. We ended the year with net debt of £996m, a £225m reduction on 2004 despite the sharp increase in the value of the US dollar to £1:$1.72 at 31 December which increased our dollar denominated net debt by £121m. The £426m proceeds from the sale of our interests in Recoletos and MarketWatch were partially used in a series of bolt-on acquisitions in education and financial information, including AGS, Co-nect and IS.Teledata.

The board is proposing a dividend increase of 6% to 27.0p. Subject to shareholder approval, 2005 will be Pearson's 14th straight year of increasing our dividend above the rate of inflation, and in the past eight years we have returned approximately £1.5bn or one-quarter of our current market value to shareholders through the dividend.

Rona Fairhead, Chief financial officer

Our progress We increased adjusted earnings per share by 24% on an underlying basis. We expect future strong underlying earnings growth in 2006 as we continue to increase margins and grow ahead of our markets.

Our progress Our free cash improved by £147m or 52% to £431m, helped by strong operating performance and working capital efficiencies. Although our cash flow benefited from some one-off factors, we expect another good cash performance in 2006.

Our progress Our return on invested capital improved from 6.2% in 2005 to 6.7% or 7.2% at constant currency. We expect a further significant improvement in 2006.