FT Publishing

| |

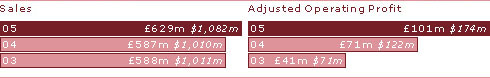

2005

£m |

2004

£m |

Headline

growth

% |

Underlying

growth

% |

| Sales |

332 |

318 |

4 |

4 |

| Adjusted operating profit |

21 |

4 |

- |

- |

Profits up by £17m on £14m sales improvement

Advertising growth continues and Financial Times returns to profit

- FT newspaper sales up 6% to £221m; £14m profit improvement to £2m.

- FT advertising revenues up 9% (and up 18% in the fourth quarter), improving through the year. Sustained growth in luxury goods and worldwide display advertising. FT.com advertising revenues up 27% as FT's biggest advertisers shift to integrated print and online campaigns.

- More than 90% of advertising revenue improvement converted to profit in 2005.

- FT's average worldwide circulation 2% lower for the year at 426,453 but 1% higher in the second half at 430,635. FT.com's paying subscribers up 12% to 84,000 and average monthly audience up 7% to 3.2 million.

Sustained progress at network of business newspapers

- Sales broadly level and profits £3m higher at the FT Group's other business newspapers and magazines.

- Les Echos advertising revenues and circulation level with 2004 (average circulation of 119,000) despite tough trading conditions.

- FT Business improves margins and profits with good growth in international finance titles.

- FT Deutschland reduces losses further despite a weak advertising market in Germany, and increases average circulation by 6% to 102,000.

- The Economist, in which Pearson owns a 50% stake, increases its circulation by 10% to 1,038,519 (for the January - June ABC period).

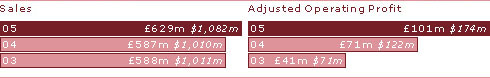

Interactive Data Corporation (NYSE: IDC)

| |

2005

£m |

2004

£m |

Headline

growth

% |

Underlying

growth

% |

| Sales |

297 |

269 |

10 |

7 |

| Adjusted operating profit |

80 |

67 |

19 |

13 |

Record results in 2005: Sales up 7% to £297m; Profits up 13% to £80m; Margins up 2% points to 26.9%.

Strong organic growth and operating improvements

- FT Interactive Data, IDC's largest business (approximately two-thirds of IDC revenues), generates strong growth in North America and returns to growth in Europe.

- Modest growth at Comstock, IDC's real-time datafeed business for global financial institutions, and at CMS BondEdge, its fixed income analytics business.

- Renewal rates for IDC's institutional businesses remain at around 95%.

- eSignal, IDC's active trader services business, increases headline sales by 27% with continued growth of subscriber base and full-year contribution from FutureSource, acquired in September 2004.

- Continued progress in transition to two new consolidated data centres, enabling IDC's four major businesses increasingly to feed off one centralised data and technology infrastructure.

Continued expansion into adjacent markets

- Acquisition of IS.Teledata for $51m (net of cash acquired) in December 2005 adds web-based financial data applications and further expands IDC's presence in continental Europe.

- Agreement to acquire Quote.com and related assets for $30m in February 2006 which will broaden IDC's range of online services for active traders and financial professionals, and create a new revenue stream in online financial advertising.

back to top